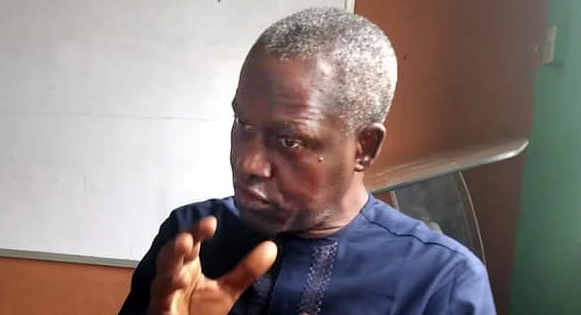

Babs Ogundeyi

Many people may not be familiar with the name Babs Ogundeyi, but the mention of Kuda Bank will definitely ring a bell. The man behind Kuda Bank is Babs Ogundeyi, a financial technology entrepreneur; the chief executive officer and co-founder of Kuda Technologies.

With his Kuda Technology he has been able to transform his dream into reality, making financial services more accessible and affordable to many Nigerians and Africans both on the continent and in the diaspora.

Education

Babs graduated from Kings College, Taunton, United Kingdom with B.A (Honours) Business Studies and Accounting. After graduating from school, he did not rest on the oars of being armed with good degree in Business Studies and Accounting as he has also developed himself to be a serial entrepreneur having been a resourceful one and a successful businessman.

Work Experience

His ingenuity in the fintech industry has democratized internet banking in Nigeria. Today, one can safely say that his bank, Kuda has captured the youth market, which has continued to grow from strength to strength.

His ambition of having youth-centric bank came into reality with the establishment of Kuda Bank in 2019 with his friend Musty Mustapha. Kuda, also known as Kuda Technologies, is a fintech company operating in Nigeria and the UK.

Headquartered in Lagos, Kuda Bank is Nigeria’s first full- service digital-only bank certified by the Central Bank firmly established in Nigeria with the responsibility of creating a youth-centric banking offering. Excitingly, the bank has distinguished itself from other competitors in the industry deploying different bank services that cater to the youth market.

Interestingly the next bus stop for Babs’ Kuda Bank was London after establishing its headquarters in Lagos. Kuda Technologies Limited (Kuda) is operating in the UK through its subsidiary, Kuda EMI Limited. It will be recalled that in 2019, the Fintech giant raised $1.6 million pre-seed financing in the UK.

Before starting Kuda Technology Babs has strong expertise in the financial services sector. He had previously spent years auditing and advising some of Africa’s biggest banks. He was also special adviser on finance to Governor Abiola Ajimobi of Oyo State from 2011-2015 and his period was marked with raising the largest infrastructural bond in the state’s history, a $55 billion bond programme. This, he was able to achieve through the knowledge he acquired during his foray in the private sector.

Through dint of hard work and tireless dedication, he positioned the state‘s microfinance bank from a $2 million loss making institution to a profit making one when he came on bord as the head of state’s Microfinance Bank.

While he was in government, Babs increased Internally Generated Profit of the state, leading to a 5x increase in 4years which put the state on strong footing financially. He also established the Public-Private Partnership (PPP) office and the Debt Management Office (DMO). Not only that, he set up and managed Oyo State Pension Contributory Scheme.

Babs entrepreneurial tentacles can also be found in magazine production when he co-founded Motor Trader Nigeria, Nigeria’s first classified car magazine. The magazine was eventually sold to a major Newspaper company in Nigeria.

Philanthropy

He was named among Nigeria’s top ten individuals who contributed enormously to the fight against Covid-19. In 2020, Kuda Bank launched a COVID-19 fund to give relief to vulnerable groups in Lagos, a densely populated megacity of over 20 million people. Apart from that, he has also contributed in several ways to youth empowerment in the country and has rendered help to many youths who have come across him.

Achievements With Kuda Bank

Babs’ achievements with Kuda Bank are numerous. Through Kuda Bank he has been able to democratise banking system. Before the establishment of Kuda Bank, banking institutions used to boast of the expansion of their branch network to the nooks and crannies of the country and even branches in other countries. All that stopped with the establishment of Kuda Bank, a full-service, digital-only bank with the provision of full banking services.

With the incursion of Kuda Bank into the financial sector in the country, many youths and other Nigerians who were techier for the services of the traditional banking institutions opened accounts with Kuda Bank because of its seamless service delivery and opportunity to automatically save money without the burden of traditional banks’ charges. Also, Babs’ Kuda introduced instant credit facilities to customers through the Kuda app. The bank also provides customers with free debit cards, delivered at no cost to customers irrespective of their locations.

Babs’ understands the youth market and that is why he is incessantly improving on Kuda App to meet the yearnings and financial needs of Africans, and to enable them access their accounts in any market where Kuda Bank is operating.

Babs’ selfless service with tenacity and focus are his staying power in business. It is on record that his digital bank Kuda opened door of opportunity for other digital banks that are really dictating the pace in the financial sector of the nation’s economy.

Babs Ogundeyi is married to Honey Oyindamola Ogundeyi. Oyindamola Ogundeyi is the chief executive officer of Fashpa Tech. She is a vlogger and an innovator. She is also the founder of Fashpa.com, a Nigerian e-commerce platform and the founder of Edukoya, an educational literacy app. The union is blessed with two children.