Image credit: Adetunji Faleye/Black Campus Magazine.

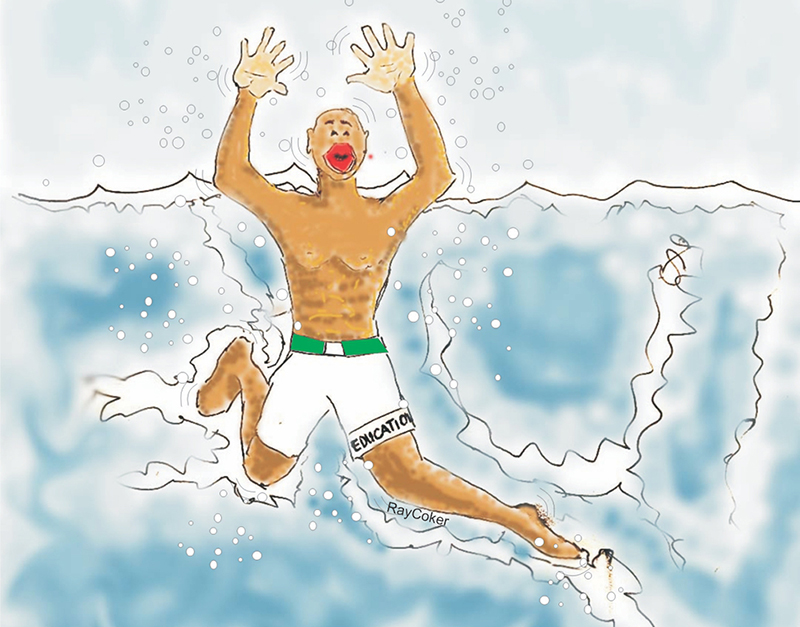

Erratic internet connection seems to be normal in Nigeria, with the country trailing the world in terms of broadband penetration and speed averages, but the impact of this may not be appreciated until it is measured in terms of time, energy and productivity.

The NBS revealed that the ICT sector accounted for 17.47% of Nigeria’s GDP in the first quarter of 2023, demonstrating a substantial rise from the 16.2% recorded in the corresponding period of the previous year. This growth signifies the increasing importance of ICT-related activities to economic development.

Nigeria has a booming digital market with about 101.7 million, or 48 per cent, of Nigerians relying on their smartphones for streaming and financial transactions, which is projected to grow to 59.7 per cent by 2026.

Despite this surge in traffic, fixed-broadband penetration in Nigeria remains sluggish and many Nigerians lament the pains they had to go through.

According to data released by the Nigeria Inter-Bank Settlement Systems (NIBSS), it revealed that E-payment transactions worth N32.84 trillion were performed in September 2022 through the NIBSS Instant payment platform.

Nigeria’s Electronic Payment Transaction Volume Was N135trn In Q1, 2023. The value of electronic payment transactions in Nigeria jumped by 298 per cent to N135. 52 trillion Year-on-Year (YoY) in the first quarter of 2023, as the cash crunch pushes more Nigerians to online transactions.

Many times when the internet is down, reporters who have deadlines to meet, especially when there is breaking news have to battle on ends before being able to get their report through.

Many people who earn their living by working remotely would often have their hearts in their mouths when these networks begin their crazy performance. Many times, some would have to move close to where these Internet providers have their transmitting masts. The anxieties associated with poor internet deliveries have no doubt productivity implications.

Pelumi, a young school leaver was enthusiastic about the possibility of getting a remote job for 500 USD for 40 hours a week, at a Canadian company as a Call Assistant. She went through some harrowing experiences in this attempt. First, it was the interview that required the internet network to be of the best quality which is difficult to accomplish here, then the interview proper which intermittently was interrupted due to poor network.

Early this year, Nigerians have had to contend with many instances of failed bank transactions made through the internet because of network failures. Deductions are made for money sent to a third party without execution and not reverted. When the banks are approached, they ask you to wait for three to seven days before issues get resolved.

Mr Olakunle Ojo presented his ATM card for a subsidized health promotion, his ATM card was returned for failed transactions, only to discover later that N25,000 had been deducted from his account. It took more than two weeks before the issue could be resolved between the health providers and the banks. This they blamed on the network.

Being a lover of internet games could be fun with friends playing across the globe. A poor network would not allow for this, as the fun will be taken away by a poor network.`

Conference call is becoming popular but could be an embarrassment with a poor network.

According to a Consultant in Marketing, Mr. Oluwole Rotimi, attributed the decline in Instant Payment Platform (NIP) transactions to glitches witnessed by some banks, stating that the surge in the exit of IT staff for greener pastures caused a lot of glitches in the banking sector that affected the customers’ transactions, coupled with introduction of the cashless policy and the botched Naira re-design which has pushed many Nigerians to embrace the e-transaction modem.

According to Tekedia Capital Syndicate, “the latest ranking saw Nigeria ranked at the 88th position in the world, dropping two places downward compared to last year’s ranking. In the overall index, Nigeria lagged behind South Africa (72nd) and Kenya (76th). The country is ranked 7th place in Africa, while South Africa emerged as the leader in the region.

“Nigeria has one of the slowest broadband connection speeds globally (13.45 Mbps), but a slightly faster mobile internet (17.91 Mbps), ranking 96th. So, we need to do upgrades on our systems as higher bandwidths are available for us to use.”

As Information Technology professionals are moving out of the country in droves and banks are groping in the dark for a way out, more needs to be done to brainstorm on how these tech-savvy individuals can be retained.

How to retain IT Professionals

Industry watchers think that banks will need to work more on how to positively motivate their IT experts to discourage them from seeking greener pastures. They need to make their pasture greener to attract tech experts and make them stay.

A finance analyst, Tokunbo Ajayi thinks that banks will need to outsource and employ IT professionals on a contract basis to fill vacant positions. Banks should be flexible enough to allow these tech personnel to work from home.

IT experts have said, that banks will also need to spend more by attracting IT personnel with fat salaries. They are already being offered fantastic salaries from tech startups and companies; hence if banks will keep them they will have to cough out much more money as salary and income together with bonuses and other fringe benefits that will win their hearts. This might not be pleasing to other non-IT workers but the management has to find a way around it.

According to an analyst who does not want his name in print, banks have to be less rigid in their operations. They need to bend some of their rules and policies, especially for tech workers to attract them.

Also, other analysts believe that, by motivating tech employees with good working conditions, they will be encouraged to stay.

It is the belief that banks are the hardest hit in the exodus of IT experts from the country due to the present economic hardship. However, banking institutions have to find ways around this and make sure they do all things possible so that this does not affect transactions and consumers in general.

They advised that proper remuneration for IT professionals, standard working conditions and opportunities to improve their knowledge, will ameliorate the present crisis in banking transactions across the country.

What’s your thought on this story?

Kindly like and share.