President Bola Ahmed Tinubu

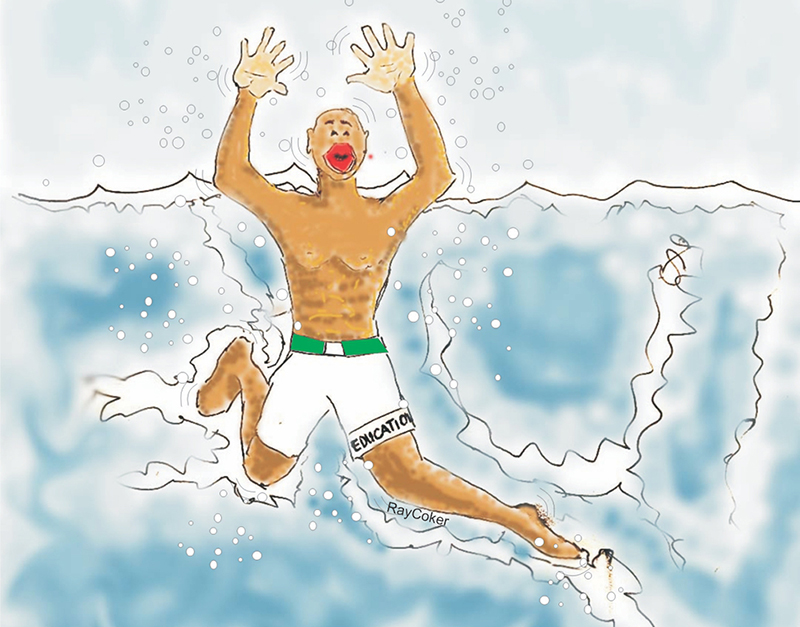

The recent suspension of the federal government’s student loan scheme has raised concerns among many Nigerians. Initially signed into law as Access to Higher Education Act, 2023 by President Bola Ahmed Tinubu in June 2023, it was intended to provide interest-free loans to underprivileged students in Nigeria’s tertiary institutions, fulfilling a campaign promise to improve education funding.

Despite being scheduled to begin in September 2023, the scheme’s implementation was delayed until January 2024. However, the presidency further postponed it from March 14, 2024, without setting a new date. The Executive Secretary of the Student Loan Board, Akintunde Sawyerr, emphasized the scheme’s importance in eliminating financial barriers to education and providing full coverage for institutional fees.

Before the suspension, Akintunde Sawyerr, the Executive Secretary of the Student Loan Board, had highlighted that the upcoming student loan application process would be automated, without human interference. He emphasized that the intention behind the Access to Higher Education Act 2023 was to ensure that financial constraints would not hinder any Nigerian from pursuing further education at the tertiary level.

Sawyerr explained that the law aimed to bridge the gap between the desire to study and the financial capacity to do so, which is often limited by lack of funding. He elaborated on the loan scheme, stating that it was intended to cover institutional fees, which encompass various charges incurred by students in tertiary institutions. The amount available would cover a hundred percent of the fees for the course of study. This scheme was specifically for public tertiary institutions, with the objective of covering the total cost of institutional fees.

Regarding the determination of income levels for eligibility, Sawyerr acknowledged that it was challenging, noting that “many families had inconsistent or irregular incomes.” He stated that the “application process would be open to all, with income levels determined for those it was feasible for while recognizing the difficulty in accurately assessing income for many families.”

Regrettably, the Nigerian government has recently made a significant policy change by announcing the suspension of student loans. This decision has sparked debates regarding its impact on higher education and the economy, drawing both support and criticism from various quarters.

The suspension comes at a time of concerns about the sustainability of the student loan programme, which was initially introduced to enhance access to higher education and alleviate the financial burden on students. However, the programme has encountered challenges, including delays in disbursement, raising questions about its effectiveness.

Proponents of the suspension argue that it will enable the government to review and improve the student loan programme, addressing issues such as disbursement delays and ensuring that it reaches those most in need. They also believe that it will ease the financial burden on students and their families, especially in the current economic climate, whenever it is reintroduced.

On the other hand, critics like Adeyemi Ayoola, a parent, are concerned that the suspension could “limit access to higher education for many students who are targeting the loans to fund their studies.” Ayoola argues that the government should instead focus on improving the efficiency and effectiveness of the student loan program, rather than suspending it altogether.

Other Clime

While the loan scheme has been postponed indefinitely in Nigeria, The Higher Education Students Financing Board (HESFB) in Uganda recently announced plans to provide loans to over 1,000 students in Uganda. The board announced that the application process will be conducted online and will run for two weeks to allow students to quickly resume their studies.

Just like in Nigeria, The Higher Education Students’ Finance Board aims to achieve several objectives, including increasing access to technical and higher education, supporting highly qualified students who cannot afford higher education, ensuring regional balance in higher education services, developing courses critical to national development, and maintaining quality education in public institutions.

Making it Simple

Uganda’s Higher Education Students’ Finance Board said to qualify for the First Year Students’ Loan TV, applicants must be Ugandan citizens, admitted to a private chartered university, public university, or a listed tertiary institution in Uganda accredited by the National Council for Higher Education (NCHE). The loan is intended to cover educational expenses for study in Uganda or abroad.

Applicants must also provide documentation such as a valid National ID, driver’s license with NIN, or passport with NIN and passport photos, have a savings account with Pride, or be willing to open an account and provide evidence of school fees requirements, such as an admission letter or institution bank slip, and a student identity card. Eligible applicants are Ugandan students who have qualified for higher education in Uganda but are unable to finance themselves.

Recommendations

Though the impact of the suspension remains to be seen, critics say those who will implement the programme need to study how it is being done in other climes. While Sola Awolola opines that the suspension of the loan scheme is capable of leading to positive reforms and improvements in the student loan programme, others fear that it could hinder access to education and have broader economic implications.

Analysts say to ensure a successful student loan scheme in Nigeria, several key factors need to be considered and implemented.

They say, there should be a transparent and efficient system for administering student loans. This includes clear eligibility criteria, streamlined application processes, and timely disbursement of funds.

Government should also ensure the financial sustainability of the scheme by balancing loan repayment terms with borrowers’ ability to repay. Consider factors such as interest rates, grace periods, and repayment plans that are realistic and flexible.

They believe that the loan should also have awareness campaigns to inform students about the availability of loans, eligibility criteria, application processes, and repayment obligations.

Implementing robust risk management practices to minimize default rates is germane. This includes a thorough assessment of borrowers’ creditworthiness, monitoring of repayment behaviour, and provision of financial counseling and support services.

By implementing these recommendations, Nigeria can develop a successful student loan scheme that enhances access to higher education, supports students in pursuing their academic goals, and contributes to the country’s socio-economic development.

What’s your thought on this story?